Market Heats Up for Disruption-Resistant Superconductors

By Joyce Pellino Crane

When electrical transmission cables and tree branches glisten in brilliant sunlight, drop your camera and run to the nearest hardware store for a generator.

I learned this hard lesson in December after an ice storm left downed wires, branches and debris throughout several counties northwest of Boston and across six other northeastern states, leaving one million without electricity, some for as long as two weeks. It will be a long time before I forget what it’s like to wrap holiday presents by a smoky fire with gloves on.

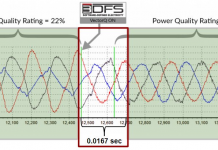

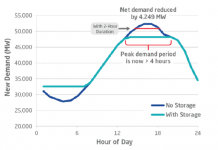

American Superconductor’s (AMSC: Nasdaq) wires run underground inside cable systems that are less susceptible to nature or terrorist attacks than the current technology. A high temperature superconductor has almost no resistance to the flow of electricity and is imbued with the capacity to transmit 150 times the power of copper wires. A key characteristic of AMSC’s superconductor technology is its ability to self-heal by automatically isolating dangerous power surges. The feature allows a smart grid to survive attacks and natural disasters without impacting the rest of the chain.

Today’s aged and inadequate power grid is linked by copper and aluminum wires that will burn or melt if too much power is pushed through them. In August 2003, a cascading voltage collapse plunged 50 million North Americans into darkness. Eight US states, from Michigan to Massachusetts, as well as the Canadian province of Ontario, were without power, in some cases, for four days. The blackout cost the US government as much as $10 billion. Canada suffered a net loss of 18.9 million work hours.

AMSC’s superconductor wires are composed of a crystalline compound of yttrium barium copper oxide (YBCO). The company, based in Devens, Mass., uses proprietary techniques to whip up its “secret sauce,” according to Jason Fredette, AMSC director of corporate communications. That technology is now being tested in Columbus, Ohio and Holbrook, NY, where a half-mile of superconductor cable in each location are sending electricity to households and businesses. In Holbrook, the Long Island Power Authority is feeding 574 megawatts of power to 300,000 homes with a 138,000 volt system. The Columbus pilot is bringing electricity to 8,600 residents and businesses through American Electric Power’s Bixby substation. Both programs are funded, in part, by the US Department of Energy.

AMSC’s superconductor wires are composed of a crystalline compound of yttrium barium copper oxide (YBCO). The company, based in Devens, Mass., uses proprietary techniques to whip up its “secret sauce,” according to Jason Fredette, AMSC director of corporate communications. That technology is now being tested in Columbus, Ohio and Holbrook, NY, where a half-mile of superconductor cable in each location are sending electricity to households and businesses. In Holbrook, the Long Island Power Authority is feeding 574 megawatts of power to 300,000 homes with a 138,000 volt system. The Columbus pilot is bringing electricity to 8,600 residents and businesses through American Electric Power’s Bixby substation. Both programs are funded, in part, by the US Department of Energy.

“Now other electric utilities from the US and overseas are seeing that the superconductor cable system isn’t much different from the regular cable system,” Fredette said, “so that gives them the confidence to try it.”

Commercial applications of AMSC’s superconductor technology are just beginning.

AMSC and LS Cable, Ltd., a Korean manufacturer, recently agreed to co-market 10 kilometers of commercial superconductor cable in power grids over the next five years. LS will sell cable systems containing the wires to utility companies across the globe.

Last month, the Tres Amigas Project announced it will use AMSC’s superconducting technology to link the three major US power grids: the Eastern Interconnection, the Western Interconnection and the Texas Interconnection. The arrangement will give renewable energy companies the means to sell power through a superconductor pipeline for the first time. [Ed. Note: We’ll have an in-depth article on Tres Amigas tomorrow.]

Superconductor electricity pipelines, according to Fredette, are underground, easy to site and access, highly efficient and controllable, offer greater security and avoid complex cost allocation issues for interstate transmission of power in contrast to competing technologies.

Over the past 52 weeks share price rose from $8.22 to $37.58 each, according to Bloomberg.

Revenues are expected to climb to about $300 million by the end of the current fiscal year on March 31, according to Fredette, as compared to $183 million in fiscal 2008. Fiscal 2009 second quarter revenues jumped to $75 million from $40 million for same period a year earlier. Wind power is the company’s other core market.

“We’re still in the midst of a very rapid growth phase,” he said, “and we see that continuing for the foreseeable future.”

Joyce Pellino Crane writes at wordtrope.com/blog. She is a Boston Globe correspondent and a business technology analyst for Trender Research. Follow her on Twitter: Wordtrope. She can be reached at joycepellinocrane-at-gmail period com>