Vacation and Meet Me at the Colorado Renewable Energy Conference or the International Peak Oil Conference.

I’m on vacation this week, so I’m going to leave you with a preview from a presentation I will be giving at the Colorado Renewable Energy Conference on Aug 29 in Golden Colorado. I’m updating my Investing in Renewable Energy presentations, and I’ve been able to incorporate a lot of the work Charles and I did on clean energy mutual funds and ETFs since January this year.

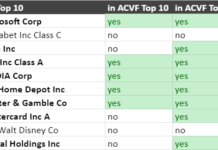

ETF Holdings Revealed

Charles did some in-depth work looking at the holdings of the ETFs this spring, and I turned it into this graph (click for the high-res version):

Looking at the holdings data, I’ve changed my favorite clean Energy ETF to QCLN, since it has a moderate expense ratio, and has more exposure to some of my favorite Clean Energy subsectors: Energy Efficiency, Clean Transport, Batteries/Electricity Storage, and Geothermal than my previous favorite, ICLN, which I picked mainly because of the expense ratio. However, I think QCLN underweights clean transport and wind more than I would like, so another good option for larger portfolios would be a portfolio of 80% QCLN and 10% each of FAN and PTRP. I prefer FAN to PWND because FAN is more focused on the wind supply chain, while PWND has more of a focus on wind park operators (Power Production.)

Evidence of a Clean Energy Fund Bubble

I also updated my chart of the number of clean energy mutual funds from March to reflect the closure of the Airshares EU Carbon Allowances Fund (ASO):

If that does not look like a bubble (in clean energy funds) I don’t know what does. It just goes to show that solid fundamentals do not prevent bubbles… solid fundamentals are often the foundation on which bubbles build their castles in the sky, to mix a metaphor. However, if you do have solid fundamentals (as I believe clean energy does) the popping of the bubble just sets the stage for years of healthy growth.

Presentations on Stock Picking

That’s not the core of the presentation, but I like to cover mutual funds and ETFs when talking to a general audience of Alt Energy enthusiasts. The real meat of the presentation, for me, is picking clean energy stocks. For that, you’ll need to wait for future articles, or come to my presentation at CREC, or the Saturday, October 10 workshop "Survive and Thrive After Peak Oil: Creating Personal Plans for the Coming Decades" at the ASPO 2009 International Peak Oil Conference, October 10-13 in Denver, CO.

At the ASPO conference, I’ll skip the mutual fund stuff altogether, and spend more time on the how-to’s of stock-picking.

DISCLOSURE: None.

DISCLAIMER: The information and trades provided here and in the comments are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.