Charles Morand

I received a press release yesterday about a new Emerging Energy Research (EER) study on wind power installations in the US for 2009 and beyond.

EER argues that US installations could be down as much as 24% in 2009 from a record 8.55 GW in 2008. While utility-led projects remain mostly on track, smaller IPPs and developers that rely on project finance or other forms of external financing are finding the current market environment challenging.

However, record growth could return as early as 2010 with 9 GW installed, driven in large part by the stimulus package. EER sees the following encouraging signs:

- Near-term growth could be helped by fiscal incentives, most notably the 30% Investment Tax Credit (ITC). Unlike a Production Tax Credit (PTC), an ITC does not require the existence of a tax liability and should lessen the industry’s reliance on tax equity investors – there are far fewer of those kicking around these days

- The possible enactment of a Federal renewable portfolio standard would provide a substantial long-term boost for the industry, and momentum is building in this direction

- New interstate transmission lines aimed at unlocking high-potential wind resources are being built or at the very least discussed

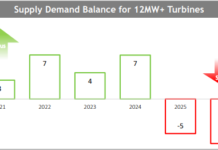

- Investments in manufacturing capacity by OEMs remain on track, indicating that the industry sees the crisis as only temporary

- Regulated utilities – with the ability to finance wind projects on-balance sheet – are making a growing commitment to wind (recently exemplified by Berkshire Hathaway’s MidAmerican Energy)

Although the wind power sector is decidedly more ‘global’ than most other forms of renewable energy – meaning there is greater geographical diversity to the industry’s aggregate revenue base – the US remains, according to Ernst & Young, the top-ranked market in the long and near terms. In the near-term, defined as the next two years, the US and China are far ahead of the pack.

The health of the global wind power sector has, in the space of a few short years, become very much tied to the health of the US wind power sector, with traditionally strong European markets such as Germany and Denmark gradually loosing their influence. What happens in the US over the next two years will thus be consequential for how wind power stocks perform.

It seems as though investors are already looking past the difficult year 2009 will almost certainly prove to be for the industry, having pushed both wind power ETFs, FAN and PWND, for beyond the rest of the market over the course of the latest bull run.

But investors beware! Just as the market was pricing in Armageddon for the clean technology/alt energy sectors just a few months ago, now might be a bit premature to get over-excited:

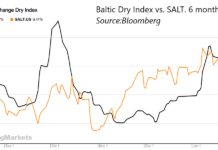

- Although credit conditions are normalizing, no one yet knows for certain what the future will look like, but many people agree that the financing environment will almost certainly remain challenging for a long time. Should inflation kick in as a result of fiscal and monetary incentives, interest rates could shoot right up in response, which would prove disastrous for any sector using large amounts of leverage

- The Federal RPS portion of the Waxman-Markey bill remains controversial and the bill will most certainly continue to undergo changes on its way to becoming law. Unless and until this happens – the bill becoming law with a Federal-level RPS in it – I am inclined to discount this entirely as a potential factor in future growth

- Transmission has certainly been on the agenda to a greater extent than at any other time in the past few decades, but we are still far – very far, in fact – from the investment levels required to truly unlock wind’s potential in America. Governance systems around grid investments remain complex, with key areas of decision-making split between various actors whose incentives are not always aligned. I would venture to say that many people still see this as a major barrier to wind development, not as an enabler

- The latest run in wind stock has been very impressive, with the ETFs outperforming the S&P 500 by 25-30%. Last fall, their relative decline was equally formidable. As pointed out earlier this week by Tom, the magnitude of gains we’ve experienced over the past three months should probably be be viewed with some caution. I’m not sure whether we’re headed for an imminent decline and, if so, how pronounced it will be (I’m a lousy market timer). But if we are, you can certainly expect wind stocks to fall further than the market as a whole. Any risk-averse investor should probably stay away at this point, or consider taking some profit

Wind continues to be among my favorite alt energy technologies and there are several years of strong growth left; the sector’s expansion is not about to normalize. However, these are uncertain times and caution is of essence. Just as an onslaught of negative sentiment pushed wind stocks further south than they should have gone a few months ago, the current onslaught on positive sentiment – which is not justified, in my view – is doing the opposite.

DISCLOSURE: None