Tom Konrad, Ph.D.

I recently moderated a panel on Financing Renewable Energy for the Colorado CFA Society. I took down choice quotes, with the plan of using them on Alt Energy Stocks’ new twitter feed. I ended up with enough material for a short article.

My panelists were Garvin Jabusch, COO of Green Alpha Advisors, a green-focused investment advisory firm in Boulder; David Gold, a partner at Access Venture Partners, and manager of their Cleantech investments, and Brian Greenman, of Greenman Financial Advisors, who does project development and finance for community wind developers. The broad range of perspectives seemed to strongly engage the audience of professional money managers and analysts.

Here are some highlights (some are paraphrases, when my notes were not word for word.)

The State of Wind

Greenman: Community wind is like the Wild West. Everything is negotiable… It gets interesting when these small players run out of something: money, turbines, anything.

Greenman: There has been only one PTC based wind deal in all of 2009 to date. People expected a bigger boost from all the attention. It will come, but it takes time and we’re going to have to wait.

The State of Cleantech Venture Capital

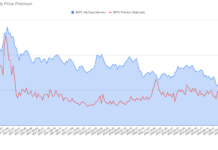

GOLD: All Venture Capital is down and that includes Cleantech. It’s not different from the rest of venture capital, except that Cleantech has been hit by a double-whammy: the falling price of our main competitor: Oil.

GOLD: There’s a big distraction factor of [early stage] companies chasing government dollars. This is good if it means they don’t go broke, but those dollars will be irrationally allocated. The stimulus will not have the same impact that the macro efforts of getting the whole economy going would.

The State of Postcarbon Stocks

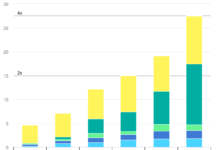

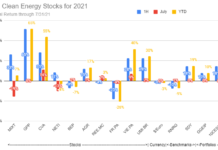

JABUSCH: Our basket of post-hydrocarbon economy stocks has been strongly outperforming the S&P 500 year to date, so we know money is flowing into the most eco-efficient companies. Since a significant number of the companies are small and micro stocks, we think that most of this is smart money.

JABUSCH: When you add a price for carbon, that will change the structure of how carbon-intensive enterprises are valued.

Try, Try Again

GOLD: Cap and Trade will be passed in some form this year. The first attempt at Cap and Trade will have many, many problems. We’ll have to go back and revisit it after we see what they are.

Solar vs. Clean Coal

JABUSCH: Solar is already way cheaper than "Clean Coal," when you count the costs of carbon sequestration, if "Clean Coal" can even be made to work.

Wind vs. Coal

Greenman: Everyone in wind wants to get away from the PTC [Production Tax Credit]. Wind is the cheapest form of electricity from new construction, and wind can compete without subsidies when fossil fuels compete without subsidies.

Getting a Job in Cleantech

Greenman: Get out there, start doing stuff, eventually you’ll get paid for it. Clean Energy is an incredibly welcoming community, and there are many organizations to help you network.

Handling Risks

GOLD: As Venture Capitalists, we won’t take policy risk. If the company will only be sucessful based on the implementation of policy XYZ, we won’t invest.

Greenman: For wind, the policy framework is the PTC and the ITC [Investment Tax Credit], and we now have several years of visibility for those. If you can get the project built in the next 2-3 years when we know that we have support in Washington, your PTC will be locked in for ten years forward… or you can take a cash grant in the form of the ITC.

JABUSCH: This is like the early stages of biotech. Everyone knew great things were going to happen, but knowing which companies would win was difficult. We therefore use big baskets of stocks (82 right now) to increase the odds we’re betting on future winners. We like to say, The writing is on the wall for clean energy, but it’s still hard to decipher.

Greenman: For wind farms, the big risks are not technology… they are getting transmission interconnection and electricity off-takers. These risks are measurable… we call it "Fatal Flaw" analysis, but the risks are always there and you have to decide.

U.S. vs. Them

JABUSCH: Everyone has a better vehicle than the GM Volt. But the markets are so big, and the opportunities are so gigantic, the US does have time to catch up with the rest of the world, and even take a leadership position again.