Last Thursday and Friday I attended the Geopowering the West Investors’ Forum in Montrose, CO (hosted by the Delta-Montrose Electric Association, Colorado’s most progressive Rural Electric Cooperative.) I’ve long been interested in geothermal stocks, and I first started adding them to managed portfolios in 2003. As a whole, those stocks have more than doubled in the 1-4 years since they were purchased.

Fundamental Advantages of Geothermal Electricity

Why did I make those first purchases? Geothermal power has some unique advantages over other forms of renewable energy.

- Geothermal is base load power. Utilities have a strong preference towards base load and dispatchable power generation (basically power which is always on or power which they can turn on at will.) In fact, geothermal plants often have capacity factors 86-95%, well above traditional base load generation such as coal. So geothermal power is a premium electricity because of its reliability. Until a recent fire (not caused by the geothermal facility) the plant installed last year at Chena Hot Springs in Alaska, was running at 99.4% availability.

- It is inexpensive. Depending on the resource, the price of geothermal power is comparable to that of wind power, new coal plants, or biomass. It is considerably less expensive than solar photovoltaic or nuclear power, or the cost projections for "Clean Coal" otherwise known as Internal Gasification Combined Cycle with carbon capture and sequestration. Using numbers presented at the conference, a geothermal power plant will cost $3-4 per rated watt, but produce about five times as much electricity as a similarly rated (and more expensive) photoelectric panel because of the much higher capacity factor.

- Geothermal has a small environmental footprint. Where solar and wind farms gather energy over large areas, a geothermal plant gathers heat from the hot rock or fluids below ground by means of one or a few wells. Because of this, the footprint needs to be only the size of the turbines which actually generate the power, smaller than the footprint of a coal fired plant generating the same amount of power, without the the necessity of coal mining and without significant emissions of carbon dioxide or other pollutants.

- In the later life of a geothermal plant, operations produce excellent income streams. While the plants often require refurbishment, with careful management geothermal reservoirs need not degrade over time, and net margins often exceed 60%.

New Developments

Why are people only now starting to talk about geothermal power?

- Geothermal electric is not a new industry. The first geothermal electric power plant was built in the 1920s. But now we have a maturing industry seeing progress in new technology. Not only can lower temperature resources now be used, but United Technologies (NYSE: UTX) has recently introduced a low temperature capable generator based on proven water chiller technology. This has the potential to rapidly increase the speed and lower the cost of project development.

- There is a growing awareness of the need for carbon-free sources of power. The IGCC’s and Al Gore’s recent win of the Nobel Peace Prize is just one recent sign of this.

- Energy Policy Act of 2005 changed the regulatory environment. There is a new commitment from national government to simpler lease structures and royalty payments.

- Current projects typically developed over a three year period, which is actually quite quick when compared to typical 5 year lead times for coal plants.

- There exists an abundance of overlooked resources because of greater temperature reach. Historical studies assumed that electricity simply could not be generated below 300 F, but new technologies can handle temperatures below 200F, which geometrically increases the number of sites with potential for generation.

- Was seen as relatively small potential until the MIT Study which came out this year. Enhanced (aka Engineered) Geothermal Systems (EGS) hold out the promise that the extractable amount of energy is not limited by the resource size or availability. There is simply so much heat stored in the Earth’s crust, that only extracting a fraction of a percentage of it would allow us to meet our energy needs for the foreseeable future. While EGS holds out promise, the technologies needed still require significant research. From an investor’s perspective, more concerned with the prospects for the next ten years than the next fifty years, EGS is much more important for the interest it generates in geothermal than it is for investment opportunities. Nevertheless, in terms of meeting our long term energy needs, I expect Enhanced Geothermal Systems to be a much cheaper and simpler solution than Carbon Sequestration from Coal plants.

- Geothermal as oil co-product. Many existing oil wells also bring up sizeable quantities of water at temperatures sufficient to run small binary cycle turbines. While this resource at any one oil well is likely to be small (less than a megawatt), aggregating all the wells in a large oil field could produce significant power at low cost given that the costs of exploration and exploratory drilling need not be paid for by the geothermal electricity generated.

Tricks of the Trade

What does a geothermal investor need to watch out for?

- Exploration risks. Prospecting for geothermal resources using remote sensing and surface sampling is useful for defining the drilling target, but does not significantly reduce the risk of not finding a resource sufficient to produce power. This is in distinct contrast with oil prospecting, where prospecting significantly reduces risk.

- Risks to resources currently in use. Attendees were treated to a Jeep tour through the geothermal history of the town of Ouray. Over twenty years ago, the city started a series of test wells around the town with the hope of finding enough geothermal hot water for a district heating system, and to keep their Hot Springs Pool open year round. All did not go as planned, and three of the owners of springs around the city filed lawsuits against the city charging that the city’s drilling had reduced their flows. The parties settled, but the city was forced to discontinue drilling. While the city of Ouray officials did not admit to decreasing flow rates of other pools, after listening to both sides, I think the owners of the springs had real grievances (and the courts seemed to agree with that assessment.)

- Unexpected effects of new technology. One large potential problem is induced seismicity [MS Word document] when trying to stimulate reservoirs in hot dry rock for EGS. One re

ason for an investor to consider geothermal development companies rather than geothermal equipment suppliers is that a company with a known geothermal resource will generally benefit from the evolution of technology, while a technology supplier could easily lose market share to competitors. - A geothermal resource developer must be able to connect to the grid. No matter how hot the resource nor how close it is to the surface, the developer must be able to connect to the electric grid at a point where there is sufficient available capacity to sell the electricity. The ability to negotiate a Power Purchase Agreement with a local utility having a respectable credit rating will also enable the developer to gain access to financing on more favorable terms.

- Ownership of geothermal resources is legally complex. As the City of Ouray found in the dispute mentioned above, unless an owner has put a resource in use, they may find that a court of law will not uphold their ownership of that resource.

- Many of the future resources to be developed are likely to be "blind." That is, there is no surface indication of the hot rock below. Exploration for such resources is likely to be more lengthy and costly than past exploration.

- As with any industry, quality management and personnel will be able to find opportunity in a crisis, while less able teams will be unable to exploit all the opportunities available.

- Skill in managing geothermal reservoirs is essential. Pumping a reservoir too quickly or reinjection of cool fluids in the wrong place can greatly reduce the production from geothermal reservoirs.

- Except when the developer plans to use less efficient and more expensive air cooling, the availability of low temperature cooling water in sufficient quantities will be necessary to generate electricity.

Companies

Here is a short list of interesting companies involved in geothermal power production and some reasons you may want to consider them for investment.

- Ormat (NYSE:ORA). Ormat is the granddaddy of geothermal stocks. A vertically integrated company, they not only explore and develop their own resources, they also will contract to manage resources for other developers (such as US Geothermal’s Raft River project). Their long history and current profitability gives them the safest pure-play geothermal stock available. They are experts with binary cycle turbines and reservoir management, as well as applying their binary cycle technology to waste heat recovery as well as a concentrating solar power experiment.

- United Technologies (NYSE: UTX) is not really a geothermal company at all, but I include them because of their recent innovation in producing low temperature binary cycle turbines on an assembly line basis, using an adaptation of their industrial chiller technology, for which they recently won a R&D 100 award. While this may never become a significant part of UTX’s bottom line, it is likely to change the economics of geothermal development for the better. I also expect to see the PureCycle turbine applied to a myriad of waste heat applications, quite possibly more than to geothermal.

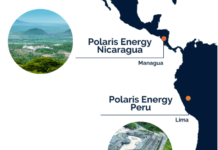

- Raser Technologies, (NYSEArca:RZ), Nevada Geothermal (OTC BB: NGLPF.OB, NGP.V) , US Geothermal (OTCBB: UGTH, GTH.TO), Sierra Geothermal (OTC: SRAGF, SRA.V), Polaris Geothermal (PGTHF.PK), and Western GeoPower Corp (WGPWF.PK, WGP.V) are geothermal developers. I find it very difficult to determine which will succeed and which will fail, and so prefer to own a little of each, buying when I feel the stocks are relatively inexpensive from a technical analysis standpoint. Raser is not a pure geothermal developer; they also develop high performance electric motor technology which is interesting to me, but the synergies are far from obvious.)

Geothermal has long been an underappreciated renewable energy technology. That seems to be changing, which will be an excellent thing both for our hope of moving to a less carbon-intensive economy, and for early investors in the sector.

DISCLOSURE: Tom Konrad and/or his clients have positions in the following stocks mentioned here: ORA, RZ, NGLPF, UGTH.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

the US only produces 2.4 GWe of geothermal power, so there still remains plenty of potential. worldwide use is quoted as 11.4 GWe. (Huttrer 2000)

another major concern is the ‘mining’ of geothermal heat. too much too soon could spoil the party.

great analysis, tom. i have linked to this post.

Thanks for the link, glad you liked the post.

Mining of geothermal heat is a large potential problem for conventional hydrogeothermal resources… That’s one advantage of experienced geothermal operators… they have the skills (from a long history of trial and error) to make sure they don’t take more heat than the resource can sustainbaly deliver.

Wondering if geothermal as an oil co-product is being persued in Western Canada. I believe Alberta alone has over 100,000 abandoned wells. Are any companies looking at this in Canada? I would be curious as to the economics involved. May help in reducing overall operating costs which in turn could lengthen economic life of certain pools.

Steve,

I don’t know that anyone is exploring the co-product option in Canada or Alberta. Most important with the abandoned wells is knowing the bottom hole temperatures (>200F at least.)

In the US the only people I know of actively pursuing this Energy America’s Geothermal division.

http://www.energyamericainc.com/index.php/geo_power/

Not all oil fields are suitable for geothermal coproduction; the technology has been demonstrated, but not deployed on a commercial scale.

I just ran across your comments, Steve and Tom, so I thought I’d wade in also. I think I can say that Energy America Geothermal is the first to take a serious look at deep O&G wells for geothermal production, as I was instrumental is getting the company started, but we are no longer the only company. I do not presently know of any companies looking at this approach in Canada, though Western GeoPower Corporation out of Vancouver is (I believe) still involved heavily with developing the South Meager Geothermal Project about 170 km north of Vancouver.

As to geothermal from O&G wells, it doesn’t all have to be co-produced. Texas alone has drilled over 600,000 wells and not all of those wells produce anymore. There is still much hot water behind pipe that can potential be produced to generate geothermal electric power.

Dr. Erdlac, Thanks for your comment.

Re: Former Oil Man Presents A Good Notion

geothernal power can give us yields comparable to nuclear power at a hundredt…

Re: Foreign Policy

its funny how the right solutions equally solves what might have otherwise se…

U.S. Geothermal, Inc: A Solid Geothermal Pure Play

US Geothermal, Inc. (HTM) is one of only two pure-play geothermal

Re: Energy independence

hogwash. energy indendence is impossible given our current levels of energy o…

I will definitely look into Energy America Geothermal’s and Western GeoPowers projects, Geothermal looks like a very viable investment, something to augment my interest in vertical axis wind turbines. Thank you all for you comments.

I like to know the name of the company and the contact person who can be contacted for buying/transfering Geothermal technology for India to produce electricity. The buying state will invest. Please reply immediately to chella@cancconsulting.com