On Monday, we learned about big coal companies pushing back against the major US corporations of the US Climate Action Partnership (USCAP,) which advocates for mandatory regulation of greenhouse gas with their own lobbyists.

Since I have advocated buying companies that take a proactive stance on climate change, I thought it might be instructive to compare the returns of the original ten members of US-CAP with the returns of the big coal coal companies (more companies have since joined,) over the six months since the Climate Action Partnership issued their Call for Action on Climate Change.

The Payoff

| Coal | Price, July 3 | YTD Dividends | Price, January 1 | YTD Return |

| ACI | $ 35.62 | $ 0.13 | $ 29.90 | 19.6% |

| BTU | $ 48.85 | $ 0.12 | $ 40.02 | 22.4% |

| CNX | $ 47.17 | $ 0.14 | $ 31.80 | 48.8% |

| MEE | $ 24.95 | $ 0.08 | $ 23.15 | 8.1% |

| Average | 24.7% | |||

| US-CAP | Price, July 3 | YTD Dividends | Price, January 1 | YTD Return |

| AA | $ 41.50 | $ 0.34 | $ 30.05 | 39.2% |

| DUK | $ 18.52 | $ 0.42 | $ 20.00 | -5.3% |

| FPL | $ 56.80 | $ 0.82 | $ 54.42 | 5.9% |

| BP | $ 73.50 | $ 1.44 | $ 67.27 | 11.4% |

| CAT | $ 77.99 | $ 0.60 | $ 61.71 | 27.4% |

| GE | $ 38.70 | $ 0.56 | $ 37.41 | 4.9% |

| PNM | $ 28.12 | $ 0.45 | $ 31.30 | -8.7% |

| LEH | $ 74.60 | $ 0.30 | $ 78.13 | -4.1% |

| PCG | $ 45.75 | $ 0.72 | $ 47.30 | -1.8% |

| DD | $ 52.13 | $ 0.74 | $ 48.70 | 8.6% |

| Average | 7.7% | |||

| Price, July 3 | Appx YTD div | Price, January 1 | YTD Return | |

| S&P500 | $ 1,525 | $ 21.70 | $ 1,418 | 9.1% |

| XLE | $ 70.75 | $ 0.39 | $ 58.31 | 22.0% |

So far, shareholders of the big coal companies have done much better than shareholders of the US Climate Action Partnership companies. The former have received a year to date total return (including dividends) of 24.7%, which easily exceeds not only the return on the market as a whole, but also is slightly higher than my proxy for the energy sector, XLE, the iShares energy sector SPDR, which returned 22%. In marked contrast, the original partnership companies returned only 7.7%, which was below the total return on the S&P500 for the same period.

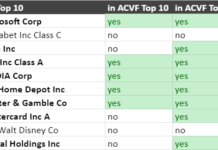

On a more optimistic note, the four companies that I have actually been buying for my own and client accounts (shown in gray) have returned a much more respectable 11.7% over the period, although naturally our returns varied from this because we did not purchase an equal-weighted portfolio of these 4 companies on January first. These selections are based on my subjective analysis of how much these companies actually stand to benefit from climate change, as well as traditional valuation and governance factors.

Conclusion

Despite the record of the last six months, we should not conclude that climate advocacy is bad for a company’s share price. Political action on climate change is a process that has only begun. If there is a payoff for climate advocacy, it will be seen over a period of years or decades, not months.

In addition, the coal companies must think that carbon regulation will hurt their bottom lines, or they would be unlikely to fight it. An investor who thinks mandatory carbon regulation is coming will therefore want to avoid owning those companies when such regulation comes to pass. Likewise, companies which self-select by joining the partnership probably expect to gain from carbon regulation.

Finally, most of us want not only to achieve our financial goals, but also to live in a world where we can enjoy them. Several recent studies have shown that the costs of dealing with climate change are far smaller than the costs of doing nothing. While we may have to give up a fraction of a percent of GDP growth in the near term , we have to balance that sacrifice against losing a large fraction of our GDP if we are confronted with the droughts, flooding and erratic weather predicted as a consequences of climate change. These effects will also be felt by your whole portfolio, including by companies that have stayed out of the debate entirely.

In the end, we want not only a nice income in retirement, we want a nice planet to retire on.

DISCLOSURE: Tom Konrad and/or his clients have positions in these companies mentioned here: FPL, CAT, GE, and DD.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.