Too Many Brownies Before Dinner

"When you feed your kid six brownies before dinner, you can’t expect him to eat the salad, no matter how good it is." So says Leslie Glustrom, a long term renewable energy advocate. This is her metaphor for why Xcel Energy (NYSE: XEL) has been reluctant to pursue Demand Side Management (DSM) and renewable energy projects in Colorado as they have been in Minnesota. Because Xcel is currently constructing 500 MW of new coal-fired generation, and they are also interested in a 300-350 MW IGCC plant by 2013, they may have little demand for new renewable generation.

A Gusher of Energy Efficiency

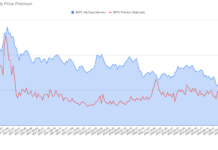

I heard a similar comment from Amory Lovins of the Rocky Mountain Institute last year. His point was that high prices for energy resulted from both the construction of new generation as well as investments in energy efficiency. He expects that the new generation resources will come online shortly after what he terms a "gusher of energy efficiency," causing energy prices to collapse. This echoes the pattern he saw in the 1986 oil price crash, where "It took nine years for President Carter’s fuel-efficiency standards to work their way into the fleet, but they were largely responsible for an 87% cut in imports from the Persian Gulf. Then President Reagan came in, right after the second and more severe oil price shock in ’79, and started pushing supply again. The combination produced a gusher of efficiency, a glut of energy, and bankrupted many of the energy suppliers the Administration had been trying to help."

Could a similar scenario unfold in today’s electric grid? I have no doubt that the energy efficiency potential is there. While most electric utilities in the United States project continued growth in demand, in line with population growth, we currently use electricity so inefficiently that there are still many energy efficiency measures available with paybacks measured in months, as opposed to years.

For instance, 8.8% of US household electricity consumption was used for lighting in 2001, most of which is used by traditional incandescent bulbs, which use about four times as much electricity as compact fluorescent bulbs (CFLs) and Light Emitting Diodes (LEDs) with similar output. If inefficient bulbs were to be banned (a move already being pursued in California and elsewhere), it is not unreasonable to think that US household electricity usage would drop by half within a year as old incandescent bulbs wear out, and US total usage could easily fall by 2%. (US household electricity usage was 43% of total usage in 2005.) So this one measure, which produces a large net savings, could negate one year’s worth of projected demand growth. Another example would be giving people real-time feedback about their energy usage, which has the potential to reduce household usage by 10-20%, a measure that could probably also pay for itself within a year, depending on how it is implemented, which could in turn reduce total usage by 4-8%. Both these measures concentrate on household usage, but commercial businesses typically have even greater potential for energy savings (just think of the effect of supermarkets not leaving their doors open constantly on summer days.)

No Room for Renewable Energy?

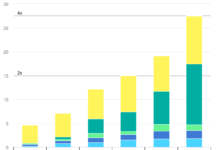

With all this cheap and easy energy efficiency potential, there should be little need to build new power plants despite increasing population growth. Yet utilities continue to project strong electricity growth so that they can justify large capital outlays on new coal fired and nuclear generation (on which they can earn a nearly guaranteed return on equity, regardless of whether the power is needed.)

This could potentially be very bad news for renewable energy investors. If electric demand does not grow, new generation will only be needed to replace old plants as they are retired, and planning and construction of a traditional coal or nuclear plant can take the better part of a decade (a sharp contrast to utility scale wind and solar farms, which can be planned and built in 1-2 years.)

Plugging in to Renewables

If energy efficiency keeps new electricity demand to a minimum, or even reduces it, and our utilities are building new fossil or nuclear generation anyway, it seems like there will be little room for new renewable generation. Nothing will be gained by not pursuing energy efficiency which is almost always much cleaner and greener than even renewable electricity. Yet this seems to leave renewable energy locked into a zero-sum game fighting for limited electrical demand with coal and nuclear, which already have a head start in the permitting process. Unlike renewable generation, which can be built quickly in small increments to match shorter-term, more accurate demand projections, large coal and nuclear plants must be built years ahead of time to meet longer term (and inherently less accurate) demand projections, a fact with the perverse consequence that planning for coal and nuclear often starts sooner, leaving renewable sources of generation squabbling for the crumbs if demand, if any such crumbs are left.

Fortunately, there is a big source of new electricity demand on the horizon. Energy Security, Peak Oil, and Global Warming concerns are driving the development of electric cars and plug-in hybrids (PHEVs). GM says that they expect to be selling their plug-in hybrid Chevy Volt as early as 2010 (although this is not yet a clear commitment), while Toyota and Ford may get there sooner. Tesla has shown that an electric car can be fun, if too pricey for an ordinary Joe. The most serious worries about large-scale deployment of plug-in hybrids I have read are 1) Battery technology is not quite ready and 2) the electric infrastructure in residential neighborhoods does not have enough capacity to cope with a large number of hybrids plugging in to recharge at night (although they may also be able to help stabilize the grid).

Investments and Actions

The "Too many brownies before dinner" scenario need not be an all-or-none possibility. Some parts of the grid will end up having more generation than they can use, while others will have too little. If you believe excess generation will be more prevalent than not, you would be well advised to avoid investing in renewable electricity companies. If, on the other hand, you think that we will fail to bring on enough energy efficiency improvements, or less conventional generation will be built than utilities are planning, or Plug-in hybrids will become prevalent within the next decade,

your renewable energy investments may still pay off.

Finally, you can also chose investments which will help promote your preferred scenario. As I mentioned above, one missing piece of the plug-in hybrid puzzle is the batteries. Advanced Lithium-Ion (Li+) batteries are widely expected to be adopted in future PHEVs. (The current generation of the Prius uses (Nickel-Metal Hydride) NiMH batteries.) Not all Li+ batteries have the unfortunate tendency to catch fire, but the added safety currently comes at the price of reduced energy capacity. Nevertheless, many companies are working diligently for a better battery, among them publicly traded Electro-Energy (EEEI) and Valence Technologies (VLNC). The largest public manufacturers of Lithium ion batteries are Sony (SNE) and Sanyo (SANYY.PK), who brought us the aforementioned burning batteries. Nevertheless, it would be foolish to rule them out of the race to produce batteries suitable for PHEVs.

You can also invest in companies involved in upgrading the electricity grid, which is a necessity even without the widespread adoption of renewables or PHEVs, if only to enhance our security from terrorism.

Finally, you can also reduce your own energy usage today, making it harder for your utility to justify high demand growth projections by reducing electricity demand growth. Your utility may already have programs you can participate in which will reduce your contribution to their demand projections. Personally, I have signed up for 100% of my electricity from Wind, and am also signed up for Xcel’s dispatchable demand program, Saver’s Switch, which gives them the ability to prevent my A/C from cycling on for short periods during peak demand. In a graphic example of how energy efficiency can pay for renewable energy, the $25 Xcel pays me annually for participating in Saver’s Switch pays for 1/3 of the current extra cost of wind power (until electricity rates rise again, at which point I may end up making money while reducing greenhouse emissions… a true win-win.

DISCLOSURE: Tom Konrad and/or his clients have positions in these companies mentioned here: XEL, EEEI, VLNC.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.