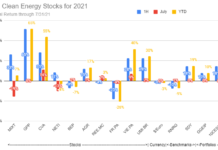

Garey Vasey, Ph.D. at Risk Center brings us a cautionary warning from the U.K. Financial Services Authority about the increasing risks of commodity investing, largely due to greater investor interest (at all levels from individuals to banks to hedgefunds) without enough true experience in this sector. I feel this same lesson applies to Renewable Energy investing. The higher these stocks rise on a tide of investor enthusiasm (as opposed to earnings fundamentals), the greater the potential for a fall. Among his other points, he says: The best and most knowledgeable energy trading talent was picked off early in this cycle and unfortunately this expertise was always thin. It is a serious issue that many investors are totally unaware of this lack of experience and more importantly perhaps, would not know what energy experience is if they saw it on display because they don’t really understand what they are investing in! This is even more true in Renewable Energy, with its typically higher fixed costs. We can see the lack of understanding among investors in renewable energy in the rapid run-ups (and crashes) of Renewable sectors such as corn-based ethanol, while economical renewables such as geothermal and wind get relatively little attention. Dr. Vasey’s article is here. It’s worth a read, and emphasizes the need to understand the what you are investing in. As a reader of Alt Energy Stocks, you’ve made a good start!