by Tom Konrad Ph.D., CFA

Sustainable infrastructure financier Hannon Armstrong (NYSE:HASI) is not in my Ten Clean Energy Stocks model portfolio for the first year since its IPO in 2013. I still love the company and its business model, but I have become concerned about its short term prospects.

Dividend Disappointment?

In my last update on the 2017 portfolio, I wrote,

“Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its floating rate debt with fixed rate debt. The company has a 60-85% target for fixed rate debt as a portion of overall debt, but the recent issuance brought this ratio to 93%.

“Since fixed rate debt bears a higher interest rate than short term debt, the increased interest payments reduced Core Earnings, and will likely do so for several quarters going forward. Although management insists that they are still looking at divided growth going forward, it now looks as if 2017 Core Earnings will be slightly below the current $1.32 per share annual dividend payment. The company has raised its dividend by at least 10% every December since it went public, but this December I expect the increase to be much more modest, probably by only 1 cent (3%) to $0.34 a quarter or $1.36 annually.”

December came, and management decided to kick the can down the road. On December 12th, HASI declared an (unchanged) $0.33 dividend for the fourth quarter, but delayed a decision on dividends for 2018.

“We have decided to move our annual dividend review to the February 2018 Q4 earnings call to coincide with our year-end results and outlook for 2018,” said President and CEO Jeffrey Eckel. “Our pipeline remains strong and we remain focused on growing the business.”

To me, this means that the company knows that if it raised its dividend in a prudent manner in December, it would disappoint investors. By delaying the decision by three months, it is buying time to grow the business by 2 to 5 percent in the interim. Note that Hannon Armstrong does not typically announce its deals publicly, so we will not know how much the business grew until the earnings announcement.

With the extra time, we could see a quarterly dividend increase of as much as 3 cents (9 percent) in February or March, although I think 2 cents (6 percent) is more likely and a 1 cent dividend increase is still possible.

HASI stock closed at $24.16 on December 28th when I finalized the list. This would have given it an expected yield of 5.8% after my expected 6% dividend per share growth in 2018. I was also concerned that more insiders have been selling than buying the stock in recent months, and the last purchase was by CEO Jeff Eckel at 10% below the current price.

Given this, Hannon Armstrong’s valuation was simply not quite as good as the other stocks in the 10 for 2018 list. Nevertheless, it remains a significant holding, and it probably would have made the list if it were trading at $22.77, where it closed on Friday January 5th, and its price when I am writing this article.

Conclusion and Thoughts for 2019

I expect that Hannon Armstrong will continue to be a well run and conservative business in 2018, and that management will raise the dividend at the lower end of my predicted range this quarter. The low dividend growth will probably cause the stock to trade flat to slightly down for most of 2018, and patient investors will see excellent buying opportunities in the latter half of 2018.

If that possible stock price weakness persists through the end of the year, you can be assured that Hannon Armstrong will make a reappearance in Ten Clean Energy Stocks for 2019.

2018 Wrap Up

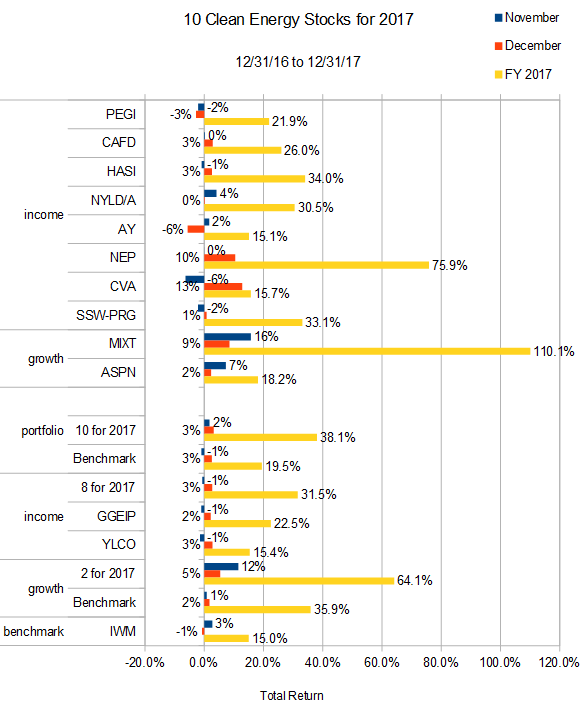

I now have the final returns for the 2018 model portfolio. It was a banner year, with a portfolio total return of 38.1% for the year, compared with its benchmark at 19.5%. My real money Green Global Equity Income Portfolio returned 22.5% and the eight income stocks returned 31.5%, both well ahead of their benchmark at 15.4%. The two growth stocks returned a whopping 64.1%, compared to their benchmark at 39%.

Individual stock performance is show in the chart below:

Disclosure: Long HASI

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Thanks Tom.

Tom,

At what price does HASI become worth looking into again. Its under $22 now and wants go lower.

I think it looks good at the current price. It would have made the list if it were trading at $22 instead of $24. It was a borderline decision as it was. Will it go lower? No idea, but if it gets close to $20 I’ll be adding to my already large position rather than just holding.