by Tom Konrad Ph.D., CFA

On a podcast recorded on September 14th, I said I thought that Yieldco stocks had bottomed at the end of September. Two weeks later, that call still looks like a good one (see chart.)

I’m starting to hear optimistic noises from other Yieldco observers, although the general tone remains quite bearish.

Why do I think September 29th was the likely bottom?

- End of quarter. Some institutional investors such as mutual funds reshuffle their portfolios at the end of the quarter so that they don’t have to report losing stocks as holdings.

- Market capitulation. Although the chart of the thinly traded Global X YieldCo Index ETF (YLCO), above, does not show the high volume selling of a typical capitulation bottom, most of the largest and most liquid Yieldco stocks do. NRG Yield (NYLD), Terraform Power (TERP), and NextEra Energy Partners (NEP) all show high volume trading on September 28th or 29th. The pattern is most dramatic for NRG Yield:

- Valuation. Valuation is usually useless for market timing, including calling bottoms. Undervalued stocks can grow even more undervalued. That said, Yieldcos are much easier to value than most stocks, especially if we assume that low stock prices will prevent growth through acquisition. In that case, a Yieldco should be worth approximately the same as its assets. Those assets are solar and wind farms, or other clean energy infrastructure will long term contracted cash flows. Since most Yieldco assets have been acquired recently, the current value of those assets should not be too different from what the Yieldco paid for them. Hence, Yieldco prices per share should never fall far below invested capital per share. If a Yieldco recently bought its assets at near market prices, tangible book value per share will be a good measure of invested capital. If the asset were acquired for in kind contributions of Yieldco stock, we may still be able to value them using a discounted cash flow analysis.

The newest Yieldco is Terraform Global (GLBL), which went public at the start of August. At the IPO, Terraform Global had a net tangible book value of $9.47 per share, compared to a $15 IPO price. At the recent price of $7.50, GLBL is trading at a 21% discount to net tangible assets, or more than a fifth less than the recent purchase price of solar farms it owns. In other words, investors seem to be assuming that any future acquisitions will fail to create (or potentially destroy) value for current shareholders, and that GLBL significantly overpaid for its current assets.

Terraform Global seems priced for nearly everything to go wrong. Even assuming that everything does go wrong, I’m happy holding the stock at $7.50 and collecting the $1.10 (15%) annual dividend.

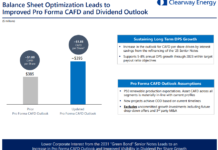

8point3 Energy Partners (CAFD) went public in June with a net tangible book value of $5.99 per share, compared to a $21 IPO price. The reason for this low tangible book value was because its sponsors First Solar (FSLR) and Sunpower (SPWR) contributed solar farms at cost. The actual value of those farms would be significantly higher if sold to unrelated parties.

Tangible book value is not particularly useful for valuing 8point3’s assets, but my colleague Jan Schalkwijk, CFA of JPS Global Investments has done a discounted cash flow analysis of 8point3 under the assumption of absolutely no revenue growth after 2026, and his estimates of nearer term revenue growth without the addition of new assets before that date. At a 7% discount rate (which seems appropriate given the low risk of 8point3’s contracted cash flows, he arrived at a value per share of $12.99. In other words, at the recent price of $13, the market is placing no value on 8point3’s potential future acquisitions, or the chance that this high quality Yieldco will recover from the current sector downturn.

So there is plenty of potential upside in CAFD shares, and we get paid an $0.84 (6.5%) annual dividend while we wait for that upside to materialize.

Conclusion

Many Yieldcos are currently trading at or below the value of their current assets. Even investors who believe that the Yieldco model is broken should consider buying and holding these stocks at current prices. If Yieldcos stay in the doldrums, and stock prices will never again recover, investors do not need the new acquisitions and dividend growth which could follow to earn an attractive risk-adjusted return.

Disclosure: Long NYLD/A, GLBL, CAFD, FSLR.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

RIGHT ON