By Jeff Siegel

Domestic Oil to Reign in 2012

Last December, I made three predictions for 2011:

- The mounting solar glut problem would be rectified by the end of the year;

- Domestic oil and gas production would increase significantly, regardless of environmental concerns related to fracking and tar sands production; and

- With the introduction of the Chevy Volt and the Nissan LEAF, domestic sales of electric cars would reach no less than 10,000 units.

Well, two out of three ain’t bad!

A Sad Season for Solar

Toward the end of 2010, we saw the writing on the wall…

Inventories of solar modules and cells were piling up just as the world’s strongest solar market, Germany, was chipping away at its very generous subsidy mechanisms.

The country’s feed-in tariff did exactly what it was designed to do: accelerate investment into solar. It did that and more.

The fact is Germany is responsible for launching the solar industry from niche player to multi-billion-dollar revenue generator.

And unlike some countries (this one in particular) where energy subsidies never seem get phased out, thereby putting a major burden on taxpayers and disallowing a free market to flourish, Germany stuck to its guns this year, told the lobbyists to stand in a corner, and began the process of phasing out those feed-in tariffs.

Of course at the start of the year, many analysts (including this one) believed that even with the phasing out of subsidies in Germany, the sector would continue to chug along.

You see, in an effort to move excess inventory out the door, solar manufacturers began to lower selling prices. The expected result was that this would allow for a pickup in demand.

That never happened.

Despite prices falling by as much as 50%, the hard truth is that it ain’t easy selling cheaper solar panels to consumers when the entire global economy is going down the crapper.

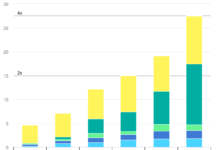

This year, nearly every major solar stock has fallen by more than 60 percent. It was an absolutely horrible year for solar stocks.

Fortunately, most energy investors don’t put all their eggs in one basket. And while I personally ate it on some solar stocks, my call on domestic oil and gas production more than makes up for it…

4.3 Billion Barrels

If you’re a regular reader of these pages, you know I’m not a huge fan of the heavily-subsidized oil and gas industry.

The billion-dollar welfare check we hand the industry every year is a slap in the face to every real free market thinker.

No matter how the bureaucrats in Washington try to spin it, there is no justification for forcing hard-working taxpayers to foot the bill for a profitable and mature industry to do business.

That being said, I can’t afford to buy a senator. I’m one guy without a K Street connection, and I don’t expect many on the Hill to trade their campaign contributions for my vote. So while I would love nothing more than to see a real, honest free market in energy, I know it’s not going to happen anytime soon…

And as a seeker of profits, I’ll take my gains where I can get them.

Which is why we’ll continue to play this angle in 2012.

Now we’ve been discussing domestic oil and gas production all year. We’ve covered the Bakken story dozens of times. And we’ll continue to cover it. After all, we’re talking about more than 4.3 billion barrels up for grabs.

That ain’t chump change, my friend. And if you think for a second that every ounce of the oil won’t be produced, you’re out of your mind.

And don’t forget, there’s another 2 billion barrels sitting at the Three Forks location. Of the wealthiest investors I know, not a single one of them is ignoring this opportunity and you shouldn’t, either.

Not the Failure They Hoped For…

|

| By Rudko [CC0], via Wikimedia Commons |

Throughout the course of 2011, I felt like I had become a representative for the electric car market, defending it from an avalanche of unfair attacks.

It still amazes me that at a time when we’re trying to displace as much foreign oil as we can, there are so many knuckle-draggers cheering for the failure of a vehicle that doesn’t need a drop of gasoline or diesel to operate.

I’m not going to sit here today and defend the electric car from all the bogus arguments we hear time and time again from the media whores and partisan slaves. (Feel free to check out this article I wrote back in 2010, where I responded to some of the more common criticisms.)

But consider my prediction from last year: With the introduction of the Chevy Volt and the Nissan LEAF, domestic sales of just these two electric cars will reach no less than 10,000 units.

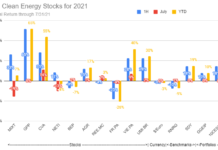

Not including December sales (which we won’t see until January), 8,738 LEAFs and 6,142 Volts have been sold in the United States.

That’s nearly 15,000 electric vehicles roughly 5,000 above my initial estimate. And this is just domestic sales. Globally, more than 20,000 Nissan LEAFs have been sold.

Just to put this in perspective, consider this: When Toyota first launched the Prius Hybrid in 1997, the Japanese automaker sold 3,000 units.

In 2011, the first year Nissan starting selling the all-electric LEAF, more than 20,000 will have been sold. Not too shabby especially considering the LEAF carries with it the burden of range anxiety, something Prius owners have never had to deal with.

(I didn’t include the Volt in this comparison because there is no range anxiety with that vehicle. Once the initial charge is depleted after 30 to 40 miles, the engine kicks in, and you can go another 300 miles or so.)

Yes, the electric vehicle market’s best days are still ahead. And that brings me to the first of my…

Predictions for 2012

It is clear that Nissan has taken the early lead in electric vehicle development, much in the same way Toyota took (and maintains) the lead in conventional hybrid vehicles.

In fact, the company announced a couple of months ago it has set a goal of selling 1.5 million electric vehicles by 2016. That’s only four years away.

As for next year, the major automakers will continue to produce and roll out their new electric offerings.

In addition to the Chevy Volt and Nissan LEAF, we’ll start to see Mitsubishi’s electric car the “i” hit the highways in 2012. Ford’s all-electric Focus is also expected to make its debut. That particular vehicle looks like it could be a real crowd-pleaser.

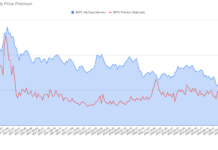

Of course, it will still carry with it a price premium. And that will likely limit early sales to early adopters…

But most analysts know that this early round of electric cars is really only intended to serve as the building blocks for future electric offerings.

Because like it or not, electric vehicles are going to be part of every major automakers’ lineup going forward.

I’m not saying electric cars will overtake the conventional internal combustion

engine anytime soon. But from a growth perspective, the opportunities for investors are undeniable.

A recent Pike Research study showed there will be more than one million plug-in electric cars on the roads in just three years. And by 2017, just about five years from now, that number will grow to 5.2 million.

By the end of this year, total plug-in sales will be around 21,000.

Considering the overall vehicle market is expected to grow 3.7 percent between 2011 and 2017, this is a massive growth story.

But as I said, the conventional internal combustion engine will still own most of the auto market for decades to come. And that means our reliance on oil is not going anywhere. As a result, expect to see a continued run on domestic oil and gas production.

Where Natural Gas is King

Moving onto utility-scale power generation, natural gas will continue to pick up where coal leaves off.

The fact is conventional coal has reached the end of its usefulness at least here in the United States. It simply cannot compete with low-cost natural gas, and as older plants retire, don’t count on utilities building many new ones that’ll comply with new regulations. It simply doesn’t make economic sense.

No, the preference for utilities will be natural gas. Although many will continue to develop their wind holdings, too…

Just last week, Duke Energy Corp (NYSE: DUK) and American Transmission bought a $3.5 billion power line project that will move wind power from Wyoming to California and the Southwest.

Most of the wind action next year will happen in the Midwest, Texas (now the leader in installed wind capacity), and Hawaii, which is desperate to transition away from having nearly 90 percent of its power generation come from diesel generators.

So to recap…

2012 will bring us:

-

More domestic oil and gas production

-

More installed wind capacity

-

More electric car production and sales

Also worth noting:

-

We’ll start to see significant depletion of the world’s solar glut by Q2 or Q3. Solar stocks will remain risky, but many are trading so low that if you can stomach the risk, it might be worth picking up a few of the more solid players in the early part of the year.

-

Despite some obstacles, the Keystone XL pipeline is going to happen. Don’t let these recent bumps in the road convince you otherwise. There’s a market for Canada’s dirtiest of oils, and it will be supplied.

-

The move to pony up more nuclear power in the U.S. will continue, although I’m not convinced it’ll get very far in 2012. Regardless of your take on nuclear, it is prohibitively expensive without massive government support. And there ain’t much of that right now. That being said, I remain bullish on new nuclear fuel technologies that enable lower cost production and safer power generation.

Overall, I’m cautiously bullish on 2012.

I don’t buy for a second that we’re going to have some miraculous recovery next year…

But I also don’t believe we’re going to be pushing wheelbarrows full of dollars and trading gold coins for bread, at least not yet.

Either way, don’t let it weigh on you. Because regardless of how things turn out in 2012 there’s always a bull market somewhere!

To a new way of life and a new generation of wealth…

Jeff Siegel is Editor of Energy and Capital, where this article was first published.