Tom Konrad CFA

Choosing the best green energy mutual fund.

In part I of this series, I looked at the costs and expenses of eight Climate Change and Alternative Energy focused Mutual Funds. I concluded that four out of the eight, the Firsthand Alternative Energy Fund (ALTEX), the Guinness Atkinson Alternative Energy Fund (GAAEX), the Winslow Green Growth Fund (WGGFX), and the New Alternatives Fund (NALFX) each cost roughly 1.5% more in terms of expenses and trading costs per year than the typical Climate Change or Alternative Energy focused Exchange Traded Fund (ETF), with the other four costing 2.5% or more per year than the typical ETF. I’ve included my chart of estimated total costs below. Click on the chart for a link to the previous article containing a full explanation of the costs shown.

Five Principles for Gaining an Edge in Alternative Energy and Climate Change Stocks

With even the least expensive mutual fund under the most generous cost assumptions costing a full 1% per year more than a typical clean energy ETF, the mutual fund managers will have to demonstrate considerable investment skill to justify the expenses.

In general, it’s very difficult to generate returns that beat the market, let alone returns that beat the market by an average of more than 1.5% per year. This is the general argument against active management: active managers come with costs, but the average active manager will produce average returns. If you agree with this argument, the best choice is to stick with a low cost, passively managed fund such as one of the sector ETF.

There are reasons to disagree, however. The Alternative Energy sector is not yet well understood by most investors. On one hand, a large portion of the population still denies the reality of Climate Change and is blithely unaware of Peak Oil. On the other hand, we have a contingent of true believers, who understand both Climate Change and Peak Oil, but who are blinded by the unrealistic hope that Alternative Energy will allow us to replace fossil fuels without fundamentally changing the way we live.

Both groups will almost certainly be proven wrong, and the investment manager who today understands how the economy must adapt to accommodate Alternative Energy should be able to outperform the mass of investors who either think nothing is happening, or think that Peak Oil and Climate Change can be “fixed” with cheap solar and electric cars.

I’ve been writing for years about what the real alternative energy future will look like, as opposed to what we might hope it to be. Here are some basic differences from the wishful thinking scenario:

- To accommodate variable Wind and Solar, we need a more robust electric grid.

- All energy will become more expensive, so investing in energy efficiency and conservation is essential.

- Biofuel production is a commodity business, and the big winners are more likely to be the owners of the feedstock (biomass and waste) than the biofuel producers.

- Expensive fuel (including expensive batteries) will lead to shifts away from the personal car and towards alternative transportation solutions.

- Solar will be a large part of our electricity mix in 20-30 years, but that probably won’t benefit today’s Solar stocks.

Alternative Energy Sector Selection

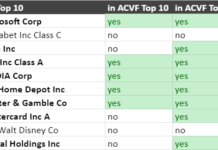

If I’m right about these principles, then a successful money manager in Alternative energy will have a fairly small investment in Solar stocks, and larger investments in Energy Efficiency stocks, biomass stocks, alternative transportation, and the electric grid. Unfortunately, there are not standard definitions of what constitutes stocks in each of the various Alternative Energy sectors, but over the last few years Charles Morand and I have built up a fairly comprehensive list of Alternative Energy stocks categorized into thirty subsectors. I used this list, along with my knowledge of the companies and online company profiles to break down the eight mutual fund’s holdings into twelve of the most commonly owned sectors.

The results are shown in the chart below.

Returning to my five principles for gaining an edge in Alternative Energy and Climate Change stocks, the easiest to apply is #5: a low allocation to Solar. Of the four funds with relatively reasonable costs, the Firsthand Alternative Energy Fund (ALTEX), the Guinness Atkinson Alternative Energy Fund (GAAEX), the Winslow Green Growth Fund (WGGFX), and the New Alternatives Fund (NALFX), both ALTEX and GAAEX have high allocations to solar stocks.

Applying the Principles

That leaves only the Winslow and New Alternatives Funds as worthy of serious consideration. Checking principle #1, we note that both have about 7% of their portfolios invested in Electric Grid stocks, a slightly higher proportion than most other funds. While this does not lead to a preference, it does help bolster the case that these fund managers may be adding value.

Principle #2, which I consider the most important of the five principles, calls

for a high allocation to energy efficiency and conservation. The Winslow fund has a strong emphasis on Green Building which I did not see in any of the other funds, and many Green Building stocks contribute to the Efficiency category (they also contribute to “Other” since much of green building does not have to do with energy.)

Principle #3 calls for a low allocation to biofuel producers, but a high allocation to Biomass and Waste (which falls under the Environmental/Recycle category in the chart.) This would seem to lead to an added advantage for the Winslow fund, but a review of Winslow’s Environmental/Recycling holdings shows that most of these are metal recyclers. The New Alternative’s much smaller holdings in this category are mostly focused on sewage treatment.

Principle #4 calls of a larger allocation to alternative modes of transportation. The Winslow fund has a much higher allocation to Transportation and Batteries (7%) than the New Alternatives Fund (2%). A closer look at the specific holdings show that the Winslow Fund’s largest holding is Rail supplier Wabtec Corporation (WAB) at 3.5%, while New Alternatives’ transportation allocation is the result of small slices of conglomerates most likely purchased for exposure to other sectors. For instance, both funds have stakes in Smart Grid and Smart Transportation company Telvent GIT SA (TLVT).

Conclusion

If I had to pick one fund to outperform because of its well chosen energy sector exposures, it would have to be the Winslow Green Growth Fund (WGGFX). That said, I believe the Winslow Fund only has a slight edge over the New Alternatives Fund (NALFX), and for someone who planned to own the mutual fund for at least a decade, I think NALFX’s lower ongoing expenses would give it the edge in long term performance. For an investor planning to hold one of the mutual funds for less than ten years, I think the Winslow Green Growth Fund is the best choice.

Of course, the least expensive way to get exposure to the right energy subsectors is by using individual stocks. I will continue this series with a look at individual stocks from these mutual fund portfolios and use them to build an Alternative Energy and Climate Change portfolio at much lower cost than investing in any of these funds. Such a portfolio should be able to take advantage of the fund managers’ stock picking skill, but with greater emphasis on the energy sectors most likely to outperform.

UPDATE: I’ve change my mind about my top mutual fund pick. See: Choosing The Right Clean Energy Mutual Fund or ETF.

DISCLOSURE: No Positions. GAAEX is an advertiser on AltEnergyStocks.com.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.