Tom Konrad CFA

Understanding the costs of green energy mutual funds.

It’s been a bit over a year since I last looked at the mutual funds in the Clean Energy sector. Each year, I comb through their portfolios for new ideas on where to invest my own funds and those of my green-minded clients, with the added bonus of being able to help readers make better decisions about which fund, if any, is right for them.

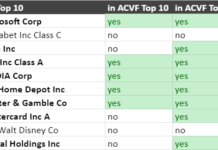

This year, I looked at the eight mutual funds from AltEnergyStocks’ green mutual fund list. In order of fund size, they are:

- Winslow Green Growth Fund (WGGFX), with $276 million in assets under management.

- New Alternatives Fund (NALFX), with $240 million in assets under management.

- Calvert Global Alternative Energy Fund (CGACX and CGAEX), at $188M.

- Allianz Global Eco Trends Fund (AECOX), at $72M.

- Guinness Atkinson Alternative Energy Fund (GAAEX), at $45M.

- DWS Climate Change Fund (WRMAX and WRMSX), at $41M.

- Gabelli SRI Green Fund (SRIGX and SRICX), at $12M.

- Firsthand Alternative Energy Fund (ALTEX), at $5.4M.

These are not the only “Green” or “Ecological” funds available. Instead, they are the funds that I feel are the best match to my own focus on clean energy, although each manager has a slightly different slant to how they approach green investing. There may be a few that should be here but aren’t: I added the Gabelli fund to the list when a reader brought it to my attention.

Fund Costs

Far too many investors put their money in a mutual fund without properly considering the costs. I think this is especially true for green minded investors, who may be more concerned about doing the right thing for the planet tahn doing the right thing for their finances.

The chart below displays some of the costs of investing in these funds. The dark blue “Max Load” are for mutual funds that have an up-front charge when you first invest. Small investments pay this percentage (between 4.75% and 5.75% of the total investment) for the right to invest, after which they pay a somewhat reduced annual expense ratio every year. (The annual expense ratio for load funds ranges from 1.02% for the New Alternatives Fund to 2.01% of the Gabelli SRI Green Fund) shown below in light blue “Load Expense Ratio.” Larger investments in load funds may qualify for a somewhat reduced sales charge or load, as a percentage of the amount invested.

No-load funds do not have an up-front charge, but typically have a slightly higher annual expense ratio, shown below in orange. The Calvert, DWS, and Gabelli funds allow both options, which is why they have two ticker symbols. Typically the no-load shares are called Class C shares, while the load shares are usually called Class A shares. No-load class C shares charge annual expense ratios ranging from 1.45% for the Winslow Green Growth Fund, to as much as 2.85% for the Calvert Global Alternative Energy Fund. Other share classes are often available to institutional investors, but I have chosen not to display them here since they are unlikely to be relevant to most of my readers.

Even the least expensive of these fund charges more than 1% each year to manage your money. Over time, that is a large drag on fund performance, so an investor should be confident that the fund manager is adding considerable value before investing in one of these funds. If the manager is not adding considerable value, it makes more sense to invest using a typical clean energy Exchange Traded Fund (ETFs). I’ve included the expenses for a typical ETF in the chart for comparison. In the case of an ETF, the “load” is the fixed brokerage commission you pay to buy the ETF; I assumed a $10 commission on a $1000 investment.

Fund Size and Expenses

It’s no coincidence that the largest funds (shown at the bottom of the chart) have the lowest expenses. There are a large number of fixed costs involved in running a mutual fund, and these show up in higher expenses (as a percentage of invested assets) for investors.

Other Expenses

While a manager cannot do a lot about the size of his fund, one source of expense he can control is trading costs. Each time a portfolio manager makes a trade, he incurs transaction costs in terms of brokerage fees, liquidity costs, and potential capital gains. Depending on how liquid the stocks are, and if the fund frequently trades in foreign markets, brokerage commissions and liquidity costs can range from 0.5% to as much as 2% or more of the value of a trade. If the fund has made profitable investments, any gain on a sale will have to be distributed to fund shareholders at the end of the year in the form of a capital gain distribution, on which tax must be paid. This is an added burden of trading for taxable investors.

A fund’s annual turnover ratio measures how often the manager trades in and out of positions, measured as the percentage of the portfolio that is traded every year. Funds with annual turnover ratios in excess of 100% trade each position more than once per year. Each fund’s annual turnover ratio is shown in the chart above.

Conclusion

On the (fairly conservative) assumption that trading costs amount to about 1% of trade value, I have combined typical fund expenses with estimated trading costs. The results are shown below. The dark blue band represents the cost of the front-end load spread over a ten year holding period, while the dark blue and light blue together represent the cost of the load if it only spread over five years. The three dark green to pale yellow bands should also be read cumulatively, with the lighter bands added on if we assume the fund’s trading costs are higher rather than lower. The lighter shades of blue and yellow represent a lower likelihood that these costs will occur.

Solely in terms of cost, the clean energy ETFs remain by far the best option. After that, the no-load funds the Winslow Green Growth Fund (WGGFX), the Firsthand Alternative Energy Fund (ALTEX), and the Guinness Atkinson Alternative Energy Fund (GAAEX) all have roughly comparable costs depending on your assumption about internal transaction costs, with low estimates of transaction costs favoring the low-turnover Guinness Atkinson fund. For a ten year holding period, the total costs of the New Alternatives Fund (NALFX) are by far the best deal, but this load fund is only comparable to these no-load funds over a five year holding period, and would be considerably worse over shorter holding periods.

In contrast the Gabelli SRI Green Fund (SRIGX and SRICX), the DWS Climate Change Fund (WRMAX and WRMSX), the Allianz Global Eco Trends Fund (AECOX), and the Calvert Global Alternative Energy Fund (CGACX and CGAEX) are more expensive than the three funds listed above, let alone the sector ETFs. The Gabelli fund not only has extremely high expenses due to its tiny size, but it then adds to these expenses with frenetic trading expressed in an unmatched turnover ratio of 190%. The Calvert funds could also do much better as well: although they have done a reasonable job fighting transaction costs by keeping turnover down, the large fund size, at four times that of the considerably less expensive Guinness Atkinson fund, leaves considerable scope for reducing investor costs.

Investors who choose the Firsthand, Guinness Atkinson, Winslow Green Growth, Firsthand, or New Alternatives funds will pay roughly 1 to 1.5 percent per year for the active management available in these funds. Given that Alternative Energy is a new and evolving sector without extensive analyst coverage, active managers may be able to gain enough of a market edge to pay for those additional costs. I will look deeper into these four fund managers’ strategies and holdings in future articles to try to determine which ones are most likely to be producing value for money.

UPDATE: I’ve change my mind about my top mutual fund pick. See: Choosing The Right Clean Energy Mutual Fund or ETF.

DISCLOSURE: No Positions. GAAEX is an advertiser on AltEnergyStocks.com.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

I would definitely be interested in some sort of value added analysis. My simple-minded analysis of a few minutes shows that if I had bought NALFX in June 2008 instead of GEX and QCLN (following your advice, but I’m not bitching ;), I’d be a lot less under water right now.

QCLN -32%

GEX -66%

NALFX -19%

However, GAAEX is -50% in the same period, so not any better.

Is NALFX lucky or good?

Is there more of a difference between managed and unmanaged in volatile times like these (see NALFX), or just as much opportunity to mess up (see GAAEX)?

I have been recommending the ETFs over the mutual funds over the last few years on the basis of price, and I now wonder if that was a mistake.

In any case, you should not compare GEX and QCLN to GAAEX, but rather to my favorite mutual funds of the same time.

I did not pick a favorite mutual fund until Feb 2009, but since then it has been WGGFX, which has strongly outperformed GAAEX since then.

But you’re right, the ETFs have generally underperformed the mutual funds. Over the last couple of years I’ve come around to the belief that active management is quite valuable in this sector (and I’m always criticizing the ETFs for too large an allocation to Solar.)

I’ve always written that a stock portfolio like my annual 10 clean energy picks is a better alternative than the ETFs because of better sector selection, but now I’m beginning to think that some of the mutual funds might be better, too.

Here’s a spoiler: I don’t currently have a favorite mutual fund, but if you have to pick one, it should be one of NALFX, WGGFX, or SRIGX. Keep reading to find out why.

Another alternative if you’re not ready to build your own portfolio is an investment advisor who will actively manage a stock portfolio and knows green energy. I know of two who are less expensive than these mutual funds… email me if you want names.