UPDATE 3/4/2011: An up-to date article on selecting green mutual funds and ETFs can be found here.

Green energy Exchange Traded Funds (ETFs) are the simplest way to invest in the sector at reasonable expense. Here is what you need to know to choose.

Tom Konrad, Ph.D., CFA

Why ETFs?

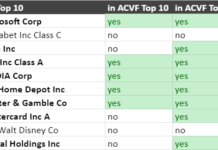

Investors interested in a simple way to invest in a diverse basket of renewable energy and energy efficiency companies should consider Exchange Traded Funds (a.k.a. ETFs) first. Although green energy mutual funds will be more familiar to many investors, they come with costs that are difficult to justify in comparison. The following chart compares the annual expense ratio, or the percentage of fund assets which an investor pays every year for ETF fund management and expenses, compared to the expense ratio of one of the less expensive green energy mutual funds. (See my recent article comparing the green energy mutual funds.)

Defenders of mutual funds will note that the cost chart is a bit deceptive, since the Guinness Atkinson Alternative Energy Fund (GAAEX), which is shown, does not have a front-end load (i.e. there is no cost to make the initial investment), but an ETF purchaser must pay a brokerage commission to buy an ETF. While true, discount brokers have driven commissions so low that this is not a significant advantage. Many brokers offer a number of free trades for opening a new account or maintaining a certain balance. When there is no cost to buy or sell the ETF, the argument in favor of mutual funds evaporates.

Even if the ETF buyer did not qualify for free trades, the comparison still favors the ETFs. GAAEX has a minimum investment of $5000 for new investors. To invest that much in an ETF through a discount broker would cost $12.95 at Charles Schwab (or considerably less at other discount brokers.) That’s a 0.1% to 0.26% brokerage commission, meaning that if you were buying an ETF with one of the highest expense ratios (0.7%) at Schwab (+0.26%), you would have broken even after holding the ETF for only 3 months. Three months is a lot better payback than you’re likely to get from solar panels!

Green Energy Sectors

The other advantage of Green Energy ETFs is sector selection. For the most part, the green energy ETFs are more narrowly focused on green energy than the mutual funds. This means that the ETFs are more volatile than the funds, rising more when the sector is doing well, but falling faster when it’s doing badly.

Several of the mutual funds contain more than 10% of their portfolios in companies I would not classify as green energy at all. Among the ETFs, that is only true for the Forestry ETFs, CUT and WOOD, which I include as a way to get exposure to biomass, but which were not designed with clean energy or climate change in mind.

The sector breakdown chart below is a team effort. AltEnergyStocks.com editor Charles Morand provided the data on the five general ETFs (PBD, QCLN, GEX, ICLN, and PBW) when he took a look at these five in May. I have since extended his analysis to the sub-sector ETFs shown.

The Best Green ETFs

At the Rocky Mountain Institute, an energy "think and do" tank, they remind us that when we’re greening our homes, we should eat our energy efficiency "vegetables" before having our renewable energy "dessert." The same is true for greening our portfolios.

The First Trust Nasdaq Clean Edge US Liquid Index Fund (QCLN) does the best job of giving our portfolio a healthy serving of energy efficiency, compared to both the other ETFs and the green mutual funds, and also has the second lowest expense ratio. If you are going to make a single investment in green energy, QCLN is my top pick.

For investors who qualify for free trades (see above), or investors putting enough into the sector that their commissions are just a fraction of a percent of the money invested, I suggest putting 80% of your money in QCLN and 20% in PTRP, the Powershares Global Progressive Transport Portfolio. For the most part, PTRP is also a serving of "vegetables" in the form of efficient transport, such as mass transit, hybrid vehicles, and even bicycles. Incidentally, bicycle dealers are having a record year even without a "cash for clunkers" scheme. [Note: this is a UK number. According to a commenter, the US numbers were down.]

One or two trades, and a balanced green energy portfolio is yours at very low cost. While you are unlikely to out-perform the sector, unlike readers who bought my 10 Green Energy Stocks for 2009 at the start of the year, you’re going to spend a lot less of your time doing it. The "10 stocks for 2009" investors had a lot less of an idea what they were getting.

DISCLOSURE: GAAEX is an advertiser on AltEnergyStocks.com;

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

I’m sure you know this already, but in addition to the brokerage commission, another (implicit) cost of trading is half the bid-ask spread. Even with $0 commissions, trading is not free.

Ted,

Mutual funds also have trading cost from bid-ask spreads and lack of liquidity, and these costs are not included in fund expense ratios.

The higher size of mutual fund trades can even lead to these trading costs being higher for mutual funds than for small traders.

Looks like you got your bike sales info from a British site tracking sales in….the UK. US bike sales are in fact down 15-30% depending on the period tracked. Makes me suspect of your other sources.

Thanks for catching that, Ben.