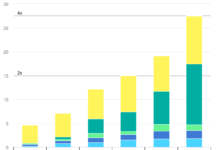

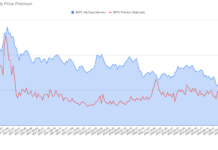

A few weeks ago, I stumbled upon a presentation that was given by FERC officials on the phenomenon of rapidly rising costs in US power generation (presentation link at the end of this post). The FERC, or Federal Energy Regulatory Commission, is America’s energy watchdog. The presentation begins by noting that across America’s major electricity hubs, power prices are up significantly on last year (between 62% in the Midwest and 123% in NYC) and that, unfortunately, this probably isn’t an anomaly. In fact, the presentation argues, there may be something secular at play. Two main trends are noted. Energy Costs Because of gas’ prevalence in US power generation, the cost of generating a unit of electricity through gas often sets the unit price in the marketplace across fuels – gas is said to be the marginal fuel. Commodity market watchers and anyone who needs to buy gas on spot or futures markets will have noticed a sharp increase in the price of gas over the past five years. This increase is what is responsible for the vast majority of power price increases currently being experienced by US electricity customers. Of course, it hasn’t helped that the price of coal has been rising as well on the back of a weak US currency and an explosion in demand from India and China. In some parts of the US, such as in the Midwest, coal is the marginal fuel. Tom wrote an interesting piece last year on how to play coal shortages. Capital Costs The second factor impacting the cost of power generation is a rapid rise in the cost of many key inputs needed to build a power generation facility. Increases in the price of steel and cement, for instance, have appreciably outpaced inflation as whole over the past few years, as have those for other commodities and even labor (albeit to a much lesser extent). The result is the chart below, which shows the capital costs of building generation capacity in 2008 as compared to 2003-2004. The caveat with this graph is that accurate data on power plant capital costs is hard to come by given the sensitivity of this information. Nevertheless, the results from these estimates show that while the inflationary environment in power generation capital costs has impacted all fuel sources, wind has been impacted to a lesser extent than competing fuels like coal. While combined cycle and combustion turbine gas remains cheaper than wind, wind has made up some ground on the 2003-2004 period. The effects of this phenomenon on power prices, however, may not be fully felt for a few more years.

Connecting The Dots Throw these two factors together (rising capital and fuel costs), and the weighted-average levelized cost of electricity across the system – the levelized cost is the present value of the costs of building and operating a power plant and are used to set prices over the plant’s economic life – looks like it could favor wind a few short years down the road. There are two forces at play improving the economics of wind relative to conventional power generation: (a) growing wind manufacturing capacity currently under construction (this is not apparent at the moment because of the inflationary environment discussed above, but once new manufacturing capacity comes on line and the supply chain loosens up wind costs will decrease) and (b) worsening economics for fossil-fired generation due to increases in capital costs but mostly fuel costs. Add to this regulation to force fossil generators to internalize the cost of carbon and a growing number state mandates for renewable power, and the picture looks even more positive. But The Real Winner Is… Unsurprisingly, the FERC expects there to be a response to rising electricity prices – in other words, demand for power is elastic. What’s the main response likely to be initially? An increase in demand-response (technologies that adjust power consumption based on prices). The FERC estimates that the first round of demand-response (the low-hanging fruit) could come in at about $165/kW, which compares rather favorably to the capital costs of the cheapest option on to the graph above, combustion turbine gas, at between $500 and $1,000/kW. And, like renewable energy, there are no fuel costs. Somewhat paradoxically, one of the main impediments to demand-response growth could be energy efficiency measures more broadly, or reducing power use at any time instead of only at peak times, which is what demand-response does. Available energy efficiency measures would cost in the order of $0.03/kWh, compared to $0.09/kWh for the fuel alone for a combined cycle gas plant. Demand-response is likely to be more popular in states where most customers have some exposure to fluctuating daily power prices, whereas energy efficiency measures may gain more ground in states where the pricing is more static for most customers. It’s The Economics, Stupid! One of the biggest beefs alt energy detractors have with the industry is that “the economics don’t make sense without state support.” (Of course such detractors generally like to avoid conversing about the mammoth tax breaks the fossil industry receives) This could very well change in the years ahead as the burden of fuel costs on the levelized cost of fossil electricity boosts wind and solar’s competitiveness. However, as shown above, the cheapest kW is the kW saved, and regulators are aware of this. Unlike cars, where the entire vehicle has to be changed to gain access to more efficient technologies, energy efficiency measures in commercial, industrial and residential buildings can be implemented fairly painlessly. Now that the “economics make sense”, expect such installations to grow in popularity

Access the FERC presentation here (PDF document).

respected sir,

i want the mechanism of gas power plants for producing power and reduce the power shortage.

Some interesting points here. The economics certainly have a lot to with it.

Yes George, the economics certainly play a large part in this and in the long-run if the economics don’t work the technology will face serious headwinds.

However, I for one think that policy-makers must be proactive on this and incent more efficiency.

Tax breaks for the oil & gas industry are, in part, leading groups to try to drill 30,000 ft below the Gulf of Mexico to access fields that contain enough oil to feed east coast refineries for about a year (http://online.wsj.com/article/SB121659593928068909.html?mod=googlenews_wsj)

If only a fraction of the capital currently being deployed to drill for O&G was directed at efficiency, the gains would be massive.